From January 2025, electronic invoicing will become mandatory for businesses in many European countries. This shift is not simply a digital upgrade—it’s a fundamental transformation of how companies handle financial documentation and compliance. The move is part of a broader governmental effort to streamline tax reporting, improve transparency and combat fraud. For businesses of all sizes, this regulation will have far-reaching implications.

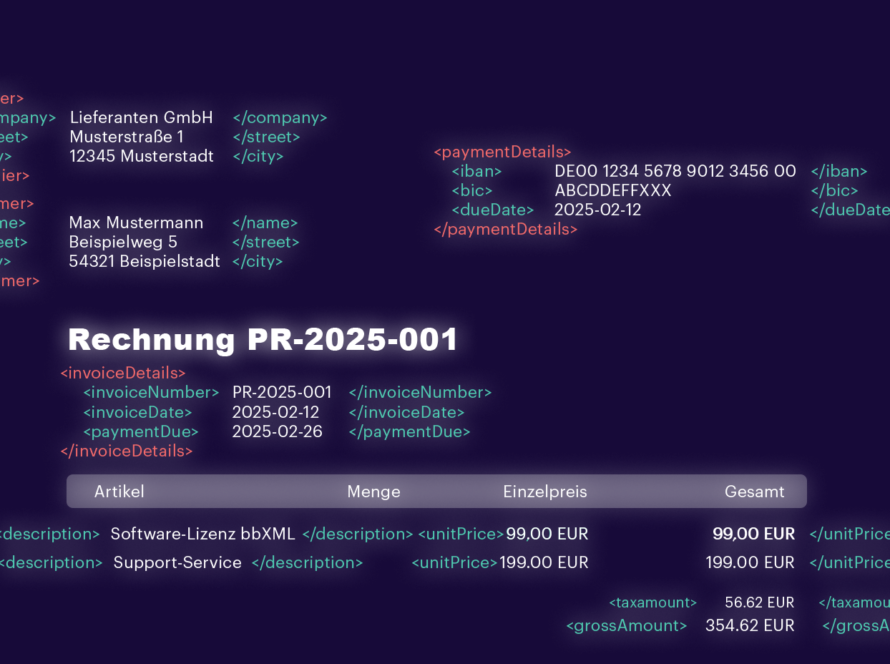

Until recently, e-invoicing was primarily used by large corporations or those dealing with the public sector. But as governments implement new policies requiring digital invoices for B2B transactions, the landscape is changing fast. Every invoice must be issued, processed and stored electronically, using specific structured formats such as XRechnung, ZUGFeRD, or Italy’s FatturaPA. These formats ensure that data is transmitted in a standardized, machine-readable way—making it easier for tax authorities to monitor and verify transactions in real time.

The intention behind this mandate is clear:

paper invoices are no longer efficient or secure enough for a modern economy. Manual errors, inconsistent documentation and fraud risks have plagued traditional invoicing methods for decades. E-invoicing, by contrast, offers speed, accuracy, and transparency—qualities that are especially valuable in a globalized, digital-first business environment.

However, the transition isn’t without its challenges. Companies must now adapt their processes to meet technical specifications they may never have dealt with before. Integrating XML formats, ensuring proper data extraction, and validating invoice contents according to regulatory rules requires time, effort and the right tools. This is where platforms like bbXML offer a significant advantage.

bbXML was developed specifically to bridge the gap between conventional invoicing practices and modern regulatory demands. Whether you’re a small business owner working with scanned PDFs or a large enterprise managing thousands of transactions monthly, bbXML automates the process of converting and validating invoices. It supports all key formats required by European authorities and integrates with a wide range of ERP and accounting systems—meaning you don’t need to rebuild your entire infrastructure to comply.

One of the most common concerns among business owners is whether they’ll be ready in time. The reality is that the earlier companies begin preparing, the smoother the transition will be. Waiting until the last moment not only increases the risk of non-compliance and potential penalties but also creates operational bottlenecks. By starting now, businesses can test their systems, train their staff and refine workflows ahead of time.

The good news is that the benefits of e-invoicing go far beyond regulatory compliance. Faster payments, reduced administrative overhead, fewer errors and increased data visibility all contribute to a more agile and responsive financial process. What initially feels like a regulatory burden often turns out to be a strategic advantage.

Ultimately, the 2025 mandate is more than a legal obligation—it’s a push toward modernization. Embracing e-invoicing now means embracing efficiency, security and long-term sustainability. And with the right support, like that provided by bbXML, the process can be far easier and more valuable than expected.